What is Swing Trading & How Does It Work?

Swing trading is a widely adopted trading strategy for traders looking for a less demanding approach. It targets medium-term market fluctuations without the high frequency of day trading. By concentrating on price swings spanning several days to weeks, traders engage with broader market trends rather than rapid transactions. This approach enables traders to leverage market trends while minimizing screen time, making it ideal for individuals with other obligations or those new to trading.

Key Takeaways

- Swing trading targets price movements over several days to weeks', allowing traders to capitalize on trends with reduced screen time and typically larger price swings than day trading, striking a balance between flexibility and structured risk management.

- The key to successful &profitable swing trading lies in patience to allow trade setups to develop and discipline to adhere to predefined exit strategies, minimizing impulsive trades and emotional reactions.

- Compared with scalping, day trading, and position trading, swing trading primarily uses 4-hour to daily charts to capture larger moves with less frequent monitoring and trading.

- Advantages of swing trading include time efficiency, lower transaction costs, and capturing significant price swings, while disadvantages involve overnight gap risk, capital being tied up longer, and sensitivity to changing market conditions.

- Beginner-friendly strategies encompass bull flags, support/resistance bounces, moving average crossovers, Fibonacci retracements, and breakouts confirmed by range structure and volume.

- Risk management focuses on position sizing (commonly 1–2% of capital per trade), ATR- or level-based stop losses, favorable reward-to-risk ratios, and techniques such as partial profit-taking or trailing stops.

- Top indicators for swing trading include volume-based tools (OBV, Volume Profile, Chaikin Money Flow), momentum oscillators (RSI, Stochastic, MACD), and trend indicators (EMAs, ADX, Ichimoku Cloud).

- An effective swing trading plan clearly defines market trends, timeframes, entry and exit criteria, position sizing, and review schedules, supported by backtesting results and a detailed trading journal for ongoing improvement.

- Starting with a broker platform like TMGM involves practicing on a demo account, utilizing risk management and educational resources, and consistently applying swing trading rules before scaling to live trading.

What Is Swing Trading? Swing Trading Explained

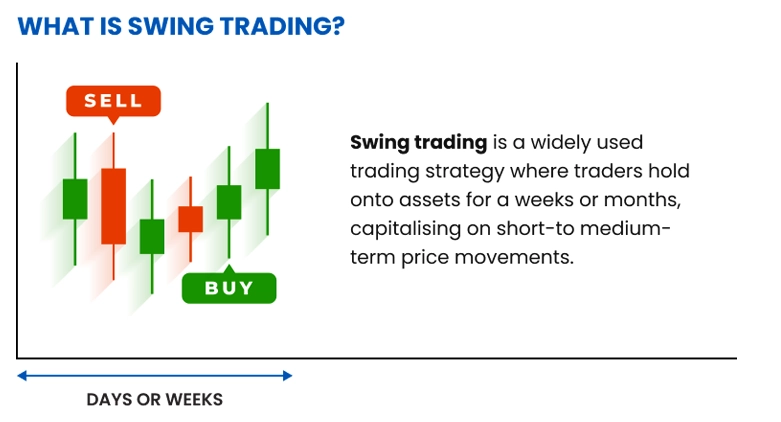

Figure 1: Illustrates swing trading as a strategy where traders hold positions for days, weeks, or months to profit from short- to medium-term price fluctuations

Swing trading is a trading style designed to capture gains over several days to weeks. Unlike day trading, which involves opening and closing positions within the same trading day, swing trading permits holding positions overnight and through weekends. However, unlike position trading or investing, it does not involve holding assets for months or years.

The optimal timeframe for swing trades ranges from 2 days up to several weeks. This approach suits traders who cannot monitor markets continuously but want to benefit from market swings while filtering out intraday noise.

Swing traders capitalize on trend momentum—often capturing 20-30% moves—for a substantial portion of the trend duration, rather than just brief segments. These price swings typically unfold in waves, including consolidations and retracements.

The Psychology Behind Swing Trading

Successful swing trading demands a balanced psychological approach, akin to the discipline required in margin trading. Traders must exercise patience to allow trades to develop per their analysis and discipline to take profits or cut losses at predetermined levels.

Swing trading’s psychological advantage lies in reducing the pressure for split-second decisions. With more time to analyze setups and manage positions, traders maintain clearer judgment and avoid emotional pitfalls common in day trading, such as revenge trading or overtrading.

Figure 2: Highlights essential psychological and discipline factors for successful swing trading

Swing Trading Compared to Other Styles

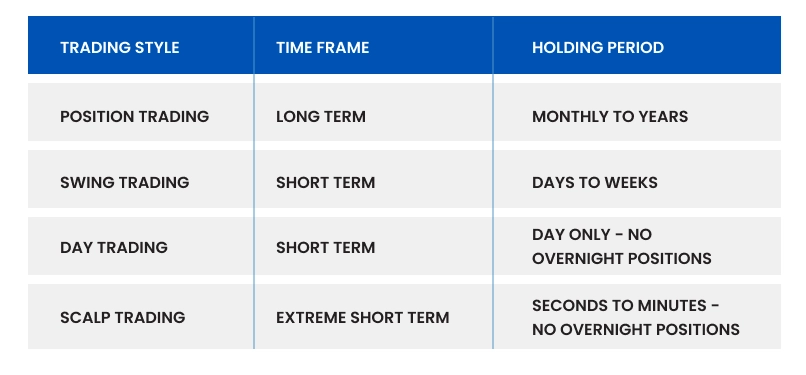

To better understand swing trading, it is useful to compare it with other popular trading styles:

Figure 2: Side-by-side comparison of trading styles, monitoring requirements, capital allocation, and market approaches

Day traders open and close positions within the same trading day

Swing traders hold positions for days or weeks

Day trading requires continuous market monitoring; swing trading requires periodic checks

Day traders typically use 1-minute to 1-hour charts; swing traders use 4-hour to daily charts

Position Trading vs Swing Trading:

Position traders hold trades for months or years

Swing traders exit once the swing completes (days to weeks)

Position traders emphasize fundamental analysis; swing traders rely more on technical analysis

Position trading requires less frequent monitoring than swing trading

Scalping vs Swing Trading:

Scalpers aim for very small price moves, holding positions for seconds to minutes

Swing traders target larger market moves

Scalpers execute dozens of trades daily; swing traders take fewer, more selective trades

Scalping demands intense focus and specialized execution tools; swing trading can be performed on standard platforms

Pros and Cons of Swing Trading

Advantages of Swing Trading

1. Time Efficiency

Swing trading demands less time commitment than day trading. The original document notes that "swing traders can achieve returns comparable to day traders with significantly less screen time. Since trades unfold over days, traders are not required to monitor every tick." This efficiency suits those balancing trading with other responsibilities, promoting better work-life balance and reducing burnout risk common among day traders.

2. Reduced Risk of Overtrading

With less screen time, swing traders are less prone to overtrading. The source states, "because swing traders spend less time watching markets, they are less tempted to overtrade. Day traders often think through trades all day and may take suboptimal trades just to remain active.'" This psychological edge supports discipline and prevents emotionally driven losses.

3. Lower Transaction Costs

Swing traders execute fewer trades, resulting in lower commissions and reduced slippage compared to higher-frequency styles. The source confirms, "swing traders pay fewer commissions, fees, and experience less slippage, which has less impact due to larger per-trade profits." Over time, these savings enhance overall profitability, especially for smaller accounts.

4. Improved Work–Life Balance

Unlike day trading, which can consume entire days, swing trading allows for a more balanced lifestyle. Traders can maintain full-time jobs, spend time with family, or pursue other interests while still actively participating in the markets. This sustainability makes swing trading a viable long-term approach for many traders.

5. Captures Significant Market Moves

Swing trading aims to capture substantial price movements. As noted, "while day traders often capture only a segment of a larger move, swing traders attempt to capture entire legs or swings up or down." This enables traders to benefit from the core of price trends rather than small fragments.

Disadvantages of Swing Trading

1. Overnight Risk Exposure

Swing traders face overnight and weekend risk, including gap openings caused by unexpected news when markets are closed. The source highlights, "those trading during the Coronavirus pandemic understand the severity of overnight risk on both long and short positions. Swing traders cannot fully mitigate overnight risk, especially in individual stocks, whereas day traders can close positions quickly." This risk necessitates additional risk management and can result in losses exceeding stop-loss levels.

2. Missing Intraday Opportunities

While day traders capitalize on multiple intraday opportunities, swing traders may miss these short-term moves. Market “trend days”——sessions with sustained, high-conviction directional moves——occur regularly. During such periods, swing traders aligned with the trend capture sizable gains, while day traders exploit multiple intraday setups like scalping and momentum trading. This means swing traders may miss profitable short-term trades that do not develop into larger trends.

3. Requires Patience and Discipline

Swing trading requires patience to allow trades to evolve over days or weeks, which can be difficult for traders used to immediate feedback from day trading. Managing drawdowns and waiting for targets demands strong emotional discipline.

4. Capital Tied Up Longer

Since positions are held longer, capital is committed to fewer trades at a time. This reduces capital efficiency and may limit new opportunities, particularly for traders with smaller accounts who cannot enter new trades while existing ones are active.

5. Market Environment Sensitivity

Swing trading strategies perform variably across market conditions. Trend-following methods excel in trending markets but may produce false signals in choppy, range-bound environments. Adaptability is crucial, as strategies effective in past regimes may underperform in new ones.

Essential Swing Trading Strategies for Beginners

Bull Flag Pattern

The bull flag is among the most reliable chart patterns for swing traders' within swing trading strategies. As the name implies, the pattern resembles a flag on a pole on the chart. It represents a brief consolidation in a strong uptrend, offering traders an entry point before the next upward leg.

Figure 2: Candlestick chart from TradingView illustrating a bull flag, a common continuation pattern in swing trading

common continuation pattern used in swing trading

Key Characteristics of Bull Flags:

A sharp upward move (flagpole) on high volume, often a 30-100% price increase

A consolidation phase with a slight downward drift (the flag), typically retracing 33% to 50% of the flagpole

Lower volume during consolidation (ideally 50% or less of the flagpole volume)

A breakout above the flag signals entry

The pattern usually forms over 1-4 weeks

The source notes, "a bull flag is a trend pullback setup named for its flag-like shape. It is a conservative pattern with high odds of continuation, typically representing a retracement of the recent swing high.''"

Trading the Bull Flag Pattern:

Identify Setup: Look for a strong upward move followed by consolidation

Confirm Volume: High volume on the flagpole, lower volume during the flag

Entry: Enter on breakout above the flag’s upper trendline with increased volume

Stop Loss: Place stop loss below the flag’s lowest point

Target: Measure the flagpole’s length and project it from the breakout point

The document emphasizes, "successful bull flags share these traits: a sharp impulse move on high volume forming the flagpole; a moderate pullback less aggressive than the initial rise; and a breakout signaling a long entry.'"

Optimal bull flag setups often occur in:

Stocks with recent strong earnings surprises (20%+ beats)

Leading stocks in strong sectors outperforming peers by 10%+

Market leaders like Apple or Microsoft during recent bull markets

Stocks making new 52-week highs

Hundreds of bull flag patterns emerge daily; focusing on high-probability setups is essential. The most profitable combine strong volume and momentum during the initial surge with muted volume during pullbacks. To refine your strategy, prioritize:

Stocks with significant earnings beats

Companies in leading sectors outperforming peers

Market leaders— such as tech giants Apple and Microsoft

Support & and Resistance Trading Strategies& Techniques

Support and resistance levels provide excellent entry points for swing traders, especially when trading with the prevailing trend. These psychological price zones mark areas where buying or selling pressure previously halted price movements.

Figure 3: Illustrates support and resistance levels, key technical analysis concepts aiding entry and exit decisions

Types of Support & and Resistance Levels:

Types of Support and Resistance:

Horizontal Support & and Resistance Levels: Price levels where the market has repeatedly reversed

Dynamic Support & and Resistance Lines: Moving averages acting as dynamic support or resistance

Psychological Price Levels: Round numbers (e.g., $50, $100) influencing trader behavior

Fibonacci Retracement Levels: Mathematically derived retracement levels based on prior price moves

Prerequisites for Effective Support/Resistance Trading:

The asset should be in a clear trend (uptrend for buying at support, downtrend for selling at resistance)

Support or resistance levels must be well-defined with multiple tests

Volume should confirm the level’s significance (higher volume on bounces)'

Implementation Tips:

Focus on leading stocks in leading sectors

Look for stocks making higher highs and higher lows (for uptrends)

Monitor momentum indicators – avoid buying when momentum declines

Consider buy stops above range highs after low-momentum pullbacks to support

The more times a level is tested, the stronger it becomes

Look for confluence of multiple support/resistance factors at the same price

Risk Management Tips:

Enter trades near support (in uptrends) or resistance (in downtrends)

Place stop losses beyond support/resistance levels (allowing some "wiggle room")

Take partial profits at the next resistance level (when buying at support)

Moving Average Crossovers

Moving average crossovers are a core swing trading strategy to detect momentum shifts and trend changes. This method uses two or more moving averages of different periods to generate buy and sell signals.

Figure 4: Displays the 50-day Simple Moving Average (SMA), a widely used trend-following indicator

Popular Moving Average Pairs:

10 and 20-day EMAs (fast crossover)

20 and 50-day EMAs (medium-term signals)

50 and 200-day SMAs (the well-known "Golden Cross" and "Death Cross")

Trading Rules:

Buy Signal: When the shorter-term MA crosses above the longer-term MA

Sell Signal: When the shorter-term MA crosses below the longer-term MA

Confirmation: Look for volume increase and confirming candlestick patterns

Advanced Swing Trading Techniques:

Use three moving averages (e.g., 5, 10, and 20-day) for stronger confirmation

Add a longer-term MA (e.g., 200-day) to identify the primary trend

Watch for moving average "compression" (convergence) before breakout moves

Fibonacci Retracement Levels

Fibonacci retracement levels assist swing traders in identifying potential reversal points during corrections. These levels (23.6%, 38.2%, 50%, 61.8%, 78.6%) are derived from the Fibonacci sequence and often act as support or resistance.

Figure 5: Illustrates Fibonacci retracement levels, a popular technical tool for identifying support and resistance zones

How to Use Fibonacci Retracements:

Identify a significant price move (swing low to swing high for uptrends)

Draw the Fibonacci retracement from the start to the end of the move

Observe price reactions at key retracement levels

Enter trades when price bounces off retracement levels in the trend direction

Best Practices:

The 38.2% and 61.8% levels are often the most reliable

Seek confluence with other indicators (moving averages, trendlines)

Confirm reversals with candlestick patterns at retracement levels

Combine with momentum indicators to assess retracement strength

Breakout Trading Strategy

Breakout trading involves entering positions when price breaks key support or resistance, leveraging the momentum that typically follows. This strategy suits volatile markets where consolidations precede strong directional moves.

Key Breakout Patterns

Common breakout formations include:

Rectangle Patterns: Price moves within a horizontal range before breaking out

Triangle Patterns: Ascending, descending, or symmetrical triangles indicating potential breakouts aligned with the trend

Head and Shoulders: Bearish reversal pattern signaling potential downward breakout

Cup and Handle: Bullish continuation pattern often leading to upside breakout

Breakout Trading Approach

To trade breakouts effectively, traders should:

Identify a well-defined consolidation with a clear breakout level

Monitor volume for confirmation of momentum

Enter trades upon decisive price break of resistance (longs) or support (shorts)

Place stop-loss orders just below breakout level (for longs) to limit risk

Set profit targets at next resistance or by measuring prior price range

Avoiding False Breakouts

False breakouts occur when price briefly breaches a key level then reverses. To reduce risk:

Wait for confirmation with a close beyond breakout level

Confirm breakout strength with above-average volume’

Apply the 2% rule: price should move at least 2% beyond breakout before entering

Trade in the direction of the broader market trend

Combining technical confirmation with disciplined risk management enhances breakout trading success and reduces common errors.

Risk Management for Swing Traders

Effective risk management is vital for long-term swing trading success. Even the best strategies incur losses; protecting capital during drawdowns distinguishes successful traders from those who deplete their accounts.

Position Sizing Strategy

Position sizing determines capital allocation per trade and is a critical risk management component.

Key Position Sizing Methods:

Fixed-Percentage Risk Model: Risk a fixed percentage (commonly 1-2%) of total capital per trade

Volatility-Based Position Sizing: Adjust size based on instrument volatility (smaller positions for higher volatility)

Tiered Position Sizing: Allocate different percentages based on conviction (e.g., 0.5% moderate, 1% high conviction)

Example: With a $10,000 account risking 1% per trade:

Maximum risk per trade = $100

If stop loss is $0.50 away, buy 200 shares ($100 ÷ $0.50)

Adjust position sizes as account value changes

Stop Loss Placement

Stop losses protect capital by automatically exiting trades when price moves unfavorably beyond a set point.

Effective Stop Loss Placement:

Technical Stops: Place stops below key support (longs) or above resistance (shorts)

Volatility-Based Stops: Use Average True Range (ATR) to set stops (e.g., 2 × ATR below entry)

Time-Based Stops: Exit trades not performing within a set timeframe

Stop-Loss Best Practices:

Effective stop-loss management controls risk and improves trade consistency. Best practices include:

Set stops at trade entry to enforce discipline and avoid emotional decisions

Avoid obvious stop levels vulnerable to stop hunts; place stops slightly beyond these levels

Use mental stops in highly volatile markets to avoid premature exits, requiring strong discipline and monitoring

Never move stops further away; adjust only to lock in profits, not to increase risk

Following these practices helps maintain structured risk management and adapt to market conditions.

Profit Target Techniques for Swing Trading

Predefined profit targets promote discipline and prevent emotional errors in managing winning trades.

Profit Target Methods:

Technical Chart Levels: Exit at key resistance (longs) or support (shorts) levels

Risk-Reward Ratio: Set targets at 2:1 or 3:1 reward-to-risk distances

Trailing Stops: Use trailing stops to lock in profits while letting winners run (e.g., 2 × ATR trailing stop)

Partial Profit-Taking: Scale out of positions by taking partial profits at multiple levels

Technical Indicators for Swing Trading

While price action forms the analysis foundation, technical indicators provide valuable insights for swing trading decisions.

Essential Volume Indicators

Volume confirms price moves and reveals trend and reversal strength.

Key Volume Indicators:

Volume Bars: Basic volume showing trading activity

On-Balance Volume (OBV): Cumulative volume indicator adding or subtracting volume based on price direction

Volume Profile: Displays volume distribution across price levels

Chaikin Money Flow: Measures buying and selling pressure over time

Using Volume:

Volume reveals the strength and sustainability of price moves, aiding confirmation of breakouts, reversals, and trend shifts.

Confirming Breakouts:: Rising volume on breakouts indicates strong participation and higher trend continuation probability. Low-volume breakouts may lack conviction and fail.

Avoiding Low-Volume False Breakouts: Price moves on declining volume suggest weakening momentum and potential trend reversal.

Recognizing Volume Spikes: Sudden volume surges often signal market exhaustion, potentially leading to reversals or corrections as buying or selling pressure wanes.

Spotting Price-Volume Divergences: If price makes new highs or lows while volume declines, it may indicate weakening trend strength and a possible reversal.

Incorporating volume analysis improves decision-making and reduces false signals.

Momentum Oscillators

Momentum oscillators identify overbought/oversold conditions, reversals, and trend strength.

Key Momentum Indicators:

Relative Strength Index (RSI): RSI measures overbought or oversold conditions by gauging price movement speed and change on a 0-100 scale Stochastic Oscillator: Compares closing price to price range over a set period

MACD (Moving Average Convergence Divergence): MACD helps identify price trends, momentum, and entry points Rate of Change (ROC): Measures percentage price change over a period

Trading Applications:

Look for divergences between price and momentum (e.g., price makes new high, RSI lower high)

Use oversold RSI (<30) for buying opportunities in uptrends

Use overbought RSI (>70) for shorting opportunities in downtrends

Confirm trend changes with MACD crossovers

Trend Following Indicators

Trend-following indicators identify market direction and strength.

Popular Trend Indicators:

Moving Averages (SMA, EMA): Show average price over a period

ADX (Average Directional Index): Measures trend strength regardless of direction

Parabolic SAR: Identifies potential price reversals

Ichimoku Cloud: Comprehensive indicator providing support/resistance, trend direction, and momentum

Indicator Implementation::

Use 20 and 50-day EMAs for medium-term trends

Consider ADX >25 as strong trend

Look for price consistently above/below key MAs

Use Ichimoku Cloud for multiple confirmations

Creating Your Swing Trading Plan

A structured swing trading plan is essential for consistency and reducing emotional decisions. It should specify market selection, timeframes, entry/exit criteria, position sizing, and trading hours. Traders decide which markets or instruments to trade, chart timeframes for analysis, and conditions for trade execution.

Swing Trading Strategy Example:

For instance, a trader might focus on S&P 500 stocks with market caps above $10 billion, using daily charts for trend detection and 4-hour charts for entry timing. A strategy could involve buying pullbacks to the 20-day EMA in strong uptrends, employing a 2:1 reward-to-risk ratio or trailing stops at twice the ATR.

Position sizing aligns with risk management, limiting risk to 1% per trade. Establishing routines— such as weekend watchlist reviews and daily setup analyses— helps maintain preparedness and discipline.

Backtesting Your Approach

Backtesting enables testing strategies on historical data before risking capital. Simulating trades under past conditions helps evaluate effectiveness, identify weaknesses, and refine methods.

The process includes defining rules, gathering historical data, and applying strategies to past price action. Key metrics include win rate, profit factor, max drawdown, and risk-adjusted returns (Sharpe ratio). This analysis aids refinement while avoiding overfitting, which can cause unrealistic live expectations.

Systematic backtesting builds confidence, improves risk management, and enhances decision-making before live trading.

Maintaining a Swing Trading Journal

Keeping a trading journal is vital for performance tracking, as outlined in our guide on cryptocurrency trading.

Journal Entries

Document each trade’s entry/exit prices, position size, and market context. Include screenshots of setups, rationale for entries, and emotional notes. Reviewing successes and mistakes helps identify behavioral patterns and improve decision-making.

Review Process:

A structured review enhances learning, including weekly trade reviews, monthly performance assessments, and quarterly strategy updates based on journal insights. Consistent journaling fosters discipline, execution quality, and long-term profitability.

Getting Started with Swing Trading at TMGM

Free Swing Trading Courses and Resources

Success in trading requires skill, knowledge, and practice. TMGM offers comprehensive courses and webinars to develop your expertise. A free demo account with US$100,000 virtual funds lets you practice risk-free and refine strategies.

TMGM also provides trading insights, market news and analysis , plus proprietary tools like Acuity and an Economic Calendar, tailored for traders at all levels. Whether you’re a beginner seeking to learn the

Trade Smarter Today

Account

Account

Instantly