What is the RSI, or Relative Strength Index?

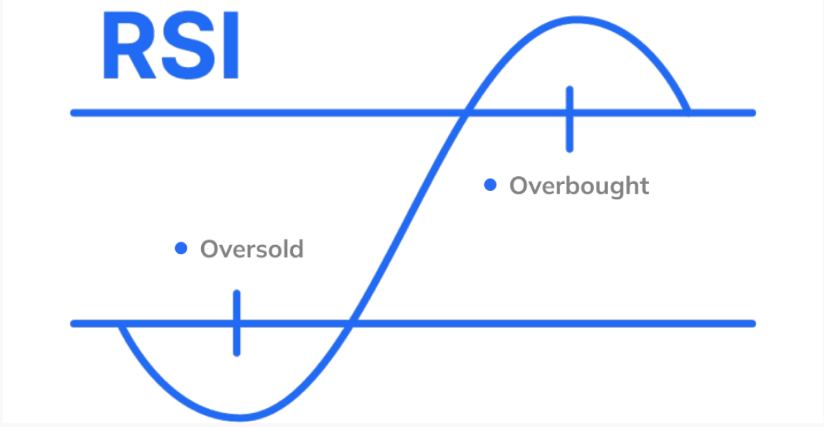

RSI, or Relative Strength Index, is a momentum oscillator utilized in trading to assess the velocity and extent of recent price movements, helping to identify overbought or oversold conditions in a financial instrument. It is presented as a line chart on a scale ranging from 0 to 100, where readings above 70 typically signal that an asset is overbought, and readings below 30 indicate it is oversold.

Key Takeaways (RSI Indicator)

The RSI is a momentum oscillator that indicates when assets are overbought or oversold.

It assists in identifying trend reversals, trend strength, and optimal entry and exit points.

Best applied alongside technical tools such as moving averages, Fibonacci retracement levels, MACD, and trendlines.

Traders should always consider the overall market context and implement sound risk management practices.

RSI performs effectively across forex, equities, and commodities, making it a versatile indicator for all types of traders.

How the RSI Indicator Works

The Relative Strength Index (RSI) is a widely utilized momentum oscillator that quantifies the velocity and magnitude of price movements. It calculates the ratio of recent average gains to average losses over a defined period, typically 14 bars. This straightforward yet powerful indicator enables traders to detect overbought and oversold market conditions, potential trend reversals, and confirm trend strength.

Here’s the methodology:

RSI Calculation Formula:

RSI = 100 - (100 / (1 + RS))

Where RS (Relative Strength) = Average Gain over N periods / Average Loss over N periods

This formula yields a value ranging from 0 to 100:

Above 70: Signals the asset may be overbought and could be poised for a corrective pullback.

Below 30: Indicates the asset may be oversold, suggesting a potential upward price correction.

Between 30–and 70: Represents a neutral zone where traders often seek additional confirmation before making decisions.

Example: If a stock’s RSI surpasses 70, it may be deemed overbought, increasing the probability of a price decline. Conversely, an RSI below 30 could indicate oversold conditions and a potential rebound.

RSI Indicator in Forex, Equities, and Commodities

The RSI indicator is effective across various asset classes:

Forex Trading:

Forex markets experience continuous price fluctuations, RSI helps identify when currency pairs are overbought (above 70) or oversold (below 30).

Equity Trading:

RSI helps spot trading stocks that are overextended or undervalued based on recent price action.

An RSI consistently above 70 may indicate overbought conditions, while below 30 could signal undervaluation and potential buying opportunities.

Commodity Trading:

Commodities such as gold, Brent crude oil, and silver exhibit strong cyclical patterns. RSI helps identify potential cycle shifts.

Example: An RSI above 70 during a gold rally may signal an opportune moment to take profits.

Confirming Trends with the RSI Indicator

RSI is valuable not only for timing entries and exits but also for confirming trend strength.

In Uptrends: RSI generally remains above 50, supporting bullish momentum.

In Downtrends: RSI typically stays below 50, indicating bearish momentum.

- Example: During a sustained EUR/USD rally, if RSI holds above 50, it reinforces the rationale for maintaining long positions.

RSI Divergence: A Powerful Signal

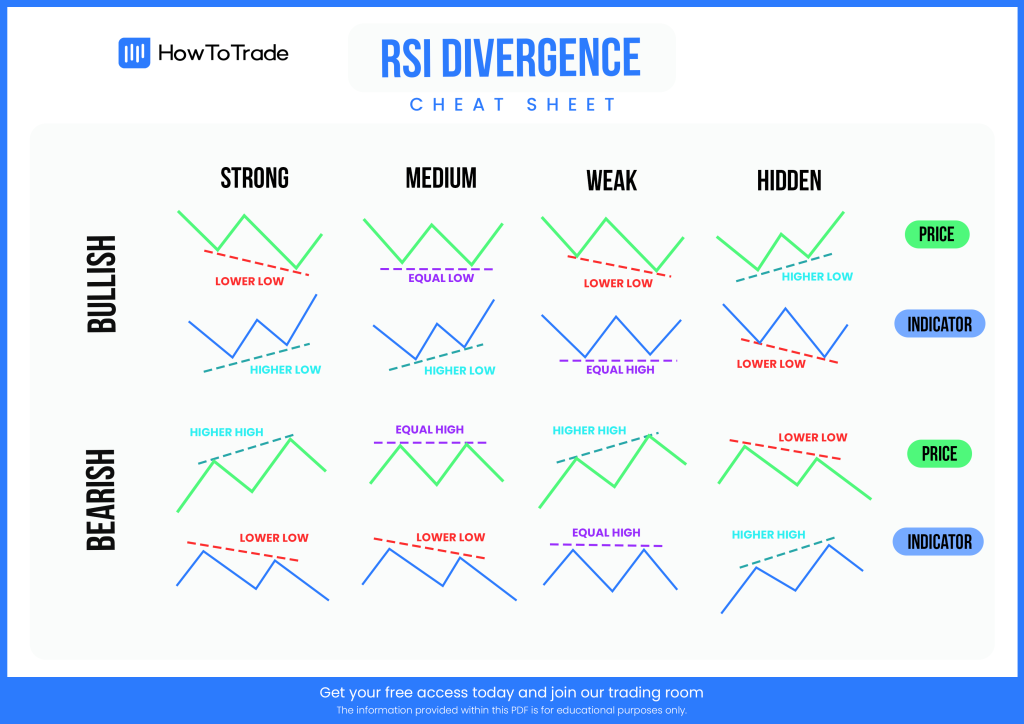

Divergences between price action and RSI can signal weakening trends or imminent reversals.

- Bearish Divergence: Price forms higher highs while RSI forms lower highs, warning of diminishing momentum and a possible sell-off.

Bullish Divergence: Price makes lower lows while RSI makes higher lows, suggesting that bearish momentum is waning and a reversal may be near.

- Example: If GBP/USD sets a new low but RSI does not, traders might anticipate a bullish reversal setup.

Combining the RSI Indicator with Other Indicators

How to integrate RSI with other indicators?

RSI’s effectiveness increases when used in conjunction with complementary technical tools.

RSI + Moving Averages: An overbought RSI signal near a 200-day moving average resistance can reinforce the case for initiating a short position.

RSI + Fibonacci Retracement: An oversold RSI at the 61.8% Fibonacci retracement level may indicate a high-probability buying opportunity.

RSI + Trendlines: Confirm RSI signals with bounces or breaks of clearly defined trendlines.

RSI + Bollinger Bands: Identify volatility expansions or contractions alongside RSI levels.

RSI + MACD: Use RSI to gauge momentum strength and MACD (Moving Average Convergence Divergence) for crossover confirmations.

Common RSI Indicator Mistakes to Avoid

Overreliance on RSI:

Traders who depend solely on RSI risk false signals. RSI should be integrated into a comprehensive strategy that includes trend analysis, support and resistance levels, and volume confirmation.

Ignoring Market Context:

In strong trending markets, RSI can remain in overbought or oversold zones for extended durations. Context is crucial——don’t automatically sell just because RSI exceeds 70 during a bullish trend.

Poor Risk Management:

RSI signals are not certainties. Always employ stop-loss orders and appropriate position sizing. For example: RSI overbought combined with a short position should include a stop-loss above recent highs.

RSI Indicator Across Different Markets: Forex, Equities, and Commodities

The RSI’’s adaptability makes it suitable for diverse markets beyond forex. Here’’s how it can be effectively applied in equity and commodity trading:

Equity Trading:

Use RSI to identify exhaustion during earnings-driven rallies or panic selling.

Divergences during earnings seasons can provide early signals of trend reversals.

Commodity Trading:

- RSI assists in navigating sharp commodity price swings driven by supply disruptions or geopolitical events.

Example: RSI divergence during an oil price spike may indicate a speculative top

The Relative Strength Index (RSI) is an indispensable tool for traders. It provides a clear, straightforward method to evaluate market momentum and anticipate potential price reversals. Due to its simplicity and effectiveness across multiple markets, including forex, equities, and commodities, it is especially beneficial for novice traders.

Applying the RSI Indicator on TMGM’’s Platform

Trading with TMGM, a leading global CFD provider, offers numerous advantages, particularly for beginner traders seeking to utilize technical indicators like the Relative Strength Index (RSI). TMGM’’s platform is designed for ease of use, delivering a seamless trading experience across forex, equities, and commodities.

Using RSI on TMGM’’s Trading Platform:

Setting up the RSI indicator on TMGM is straightforward and efficient. Whether using the web or desktop platform, the RSI can be configured within a few clicks to support sophisticated trading strategies. Whether employing day trading or swing trading across forex, equities, or commodities, the RSI indicator remains one of the most powerful tools to master.

Here’’s how TMGM enhances RSI-based trading:

Customize RSI Periods: Adjust the RSI timeframe to suit scalping strategies or extend it for swing trading—TMGM enables you to tailor settings to your trading style.

Overlay with Other Indicators: Combine RSI with moving averages, Bollinger Bands, or MACD using TMGM’’s advanced charting capabilities.

Real-Time RSI Monitoring: Respond swiftly to overbought or oversold signals thanks to TMGM’’s low-latency infrastructure and rapid order execution.

Learn as You Trade: TMGM provides tutorials, webinars, and articles to help you master RSI and integrate it into a comprehensive technical strategy.

Educational Resources:

New traders can access step-by-step tutorials, webinars, and live trading examples to learn how to interpret RSI signals and combine them effectively with other technical indicators.

Optimized for Beginners

TMGM’’s platform is designed to accommodate traders of all experience levels, with particular benefits for beginners. The platform’s intuitive interface and extensive educational materials make it an excellent choice for those new to trading. By leveraging RSI on TMGM, beginners can build a strong foundation in technical analysis within a supportive and efficient trading environment.

Ready to start trading on a platform that offers powerful tools like RSI and much more? Visit TMGM today to explore their platform and elevate your trading. Whether you’re just beginning or aiming to refine your strategy, TMGM provides the tools and support necessary to succeed in the markets.

Trade Smarter Today

Account

Account

Instantly