What is Margin in Forex and How to Calculate It?

In forex trading, margin is a fundamental concept that enables traders to control larger positions than their initial capital by utilizing leverage. Essentially, margin represents the collateral or funds that traders allocate to open and sustain a leveraged position in the market. Grasping how forex margin functions is vital, as it directly affects both risk exposure and potential returns. This overview will explain forex margin, its operational mechanics, the distinction between margin level and margin call, and the importance of understanding these concepts for effective risk management in forex trading.

Key Takeaways

Margin = collateral, not a fee. It’s the deposit required to open and maintain leveraged positions (e.g., 100:1 leverage → means $1,000 margin controls a $100,000 position).

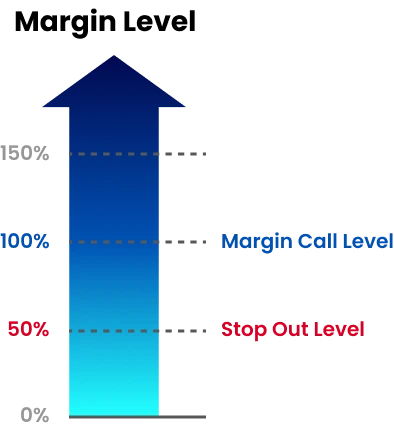

Margin level = (Equity ÷ Used Margin) × × 100%. Approaching ~100% can trigger trading restrictions; falling below the broker’s threshold may result in a margin call or automatic position liquidation.

Free margin = Equity − Used Margin (available funds for new trades and to absorb drawdowns). Used margin represents capital locked in open positions. Continuous monitoring of both is essential.

Margin calls are risk management mechanisms. When equity declines too much, brokers may issue warnings, restrict new trades, or forcibly close positions. Avoid margin calls by using appropriate position sizing, stop-loss orders, and conservative leverage.

Best practices prevent common errors. Maintain a safety buffer, align leverage with your risk tolerance and market volatility, and never over-leverage or disregard margin alerts. TMGM’’s platforms, calculators, and educational resources can assist in effective margin management.

What is Margin in Forex?

In forex trading, margin is the capital a trader must deposit to open and maintain a leveraged position. It is not a fee but serves as collateral to cover potential losses. Margin is typically expressed as a percentage of the total trade size. For example, with 100:1 leverage, opening a $100,000 position requires a $1,000 margin deposit. This enables traders to control larger positions than their account balance alone would allow, but also increases risk exposure if the market moves unfavorably.

Margin Level in Forex

What is Margin Level in Forex?

In forex trading, the margin level is the percentage ratio of a trader’’s equity to used margin. It indicates how much capital is available relative to margin requirements.

How to Calculate Margin Level in Forex

Margin level is calculated as (Equity / Used Margin) × 100. For example, if a trader has $1,000 equity and $500 used margin, the margin level is 200%.

Importance of Margin Level in Forex

Forex brokers monitor margin levels to evaluate risk. When the margin level falls below a critical threshold, typically 100%, the broker may issue alerts or restrict new trades.

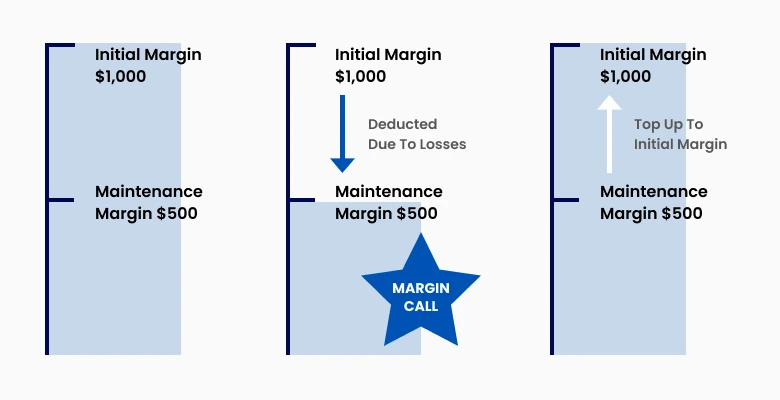

What is a Margin Call in Forex?

Margin level is calculated as (Equity / Used Margin) × 100. For example, if a trader has $1,000 equity and $500 used margin, the margin level is 200%. A margin call is a notification from the broker indicating that the trader'’s equity has fallen below the minimum required margin level due to losses.

Purpose of a Margin Call

Margin calls function as a risk management tool to protect both the trader and the broker. They prevent further losses by requiring additional funds or closing positions.

How to Avoid Margin Calls

Effective risk management through appropriate position sizing and stop-loss orders reduces the chance of margin calls. Selecting leverage levels that match your risk tolerance is also crucial.

Free Margin vs. Used Margin

What is Free Margin in Forex?

Free margin is the amount of funds in the trading account available for opening new positions. It is the difference between equity and used margin.

What is Used Margin?

Used margin is the portion of funds locked in open trades. Once positions are closed, this margin is released and becomes free margin again.

Importance of Margin in Forex

Understanding the distinction between free margin and used margin is vital for effective position management, especially when multiple trades are active simultaneously.

Why Forex Margin Matters

Risk Management: Forex margin is critical for controlling trading risk. By managing leverage and margin levels, traders can avoid overexposure and limit potential losses.

Maintaining a Sustainable Balance: Balancing leverage with available free margin ensures traders have sufficient capital to endure market volatility and prevent forced liquidations.

Empowering Strategy: A thorough understanding of forex margin enables traders to develop more effective trading strategies, maximizing profits while minimizing risks.

Common Mistakes in Managing Forex Margin

Over-leveraging: Applying excessive leverage without fully understanding margin requirements can cause rapid losses, especially in volatile markets.

Mastering Forex Margin for Better Trading

Whether you are new to forex or seeking to enhance your expertise, understanding how forex margin operates can provide a competitive advantage in the market.

To access advanced tips and strategies in forex trading, TMGM offers comprehensive educational materials and tools designed to help traders understand forex margin and leverage it effectively. Visit TMGM to elevate your trading skills today.

Trade Smarter Today

Account

Account

Instantly