Understanding What is Lot Size in Trading

When trading instruments such as stocks, forex, or futures contracts, individual units are not typically bought or sold directly; instead, traders operate using lot sizes as the standardized unit of measurement. A lot size defines a specific quantity of the underlying asset being traded. Whether you are trading equities, currency pairs, or fixed income securities, the lot size standardizes the transaction volume, facilitating easier comparison across diverse markets. Understanding lot size is essential for traders, as it determines the amount of an asset being bought or sold and plays a critical role in risk management and profit optimization. This guide will explore the details of lot size, its application across different asset classes, and demonstrate how to utilize a lot size calculator to enhance your trade management strategies.

What is a Lot Size in Trading?

A lot size refers to a predefined quantity of a financial instrument involved in a trade. Essentially, it specifies the number of units of an asset you are buying or selling in a single transaction. Lot sizes help traders standardize trade volumes across different instruments, ensuring consistency in trading operations.

In equity trading, a typical lot size might be 100 shares, whereas in markets such as forex, futures, or fixed income, lot sizes vary according to the specific instrument. Understanding lot size is critical as it directly impacts the potential profit or loss of a trade.

What is Lot Size in Forex Trading

What is Lot Size in Forex Trading

Types of Lot Sizes Across Markets

Different financial markets utilize various lot sizes tailored to their asset classes. Key examples include:

1. Stocks

In equities, the standard lot size is typically 100 shares. For example, trading one "lot" of XYZ stock generally means trading 100 shares. While this remains the conventional unit for equity trading, fractional shares and smaller lot sizes are increasingly offered by certain brokers.

2. Bonds

Bond lot sizes are generally much larger than those for stocks. Unlike the standard 100-share equity lot, bonds are often issued in denominations of $100,000 or more, with many institutional bond trades occurring in multiples of one million dollars.

For retail investors, bond mutual funds or exchange-traded funds (ETFs) provide more accessible exposure without the need to purchase large bond lots.

3. Futures

In futures markets, lot sizes are referred to as "contract sizes", which vary widely depending on the underlying asset. Futures contracts may represent equities, fixed income, interest rates, or commodities.

For example, one futures contract on the Japanese yen represents 12,500,000 yen, while one British pound futures contract represents 62,500 GBP. These contract sizes are fixed, meaning traders cannot modify the lot size within a single contract.

4. Forex

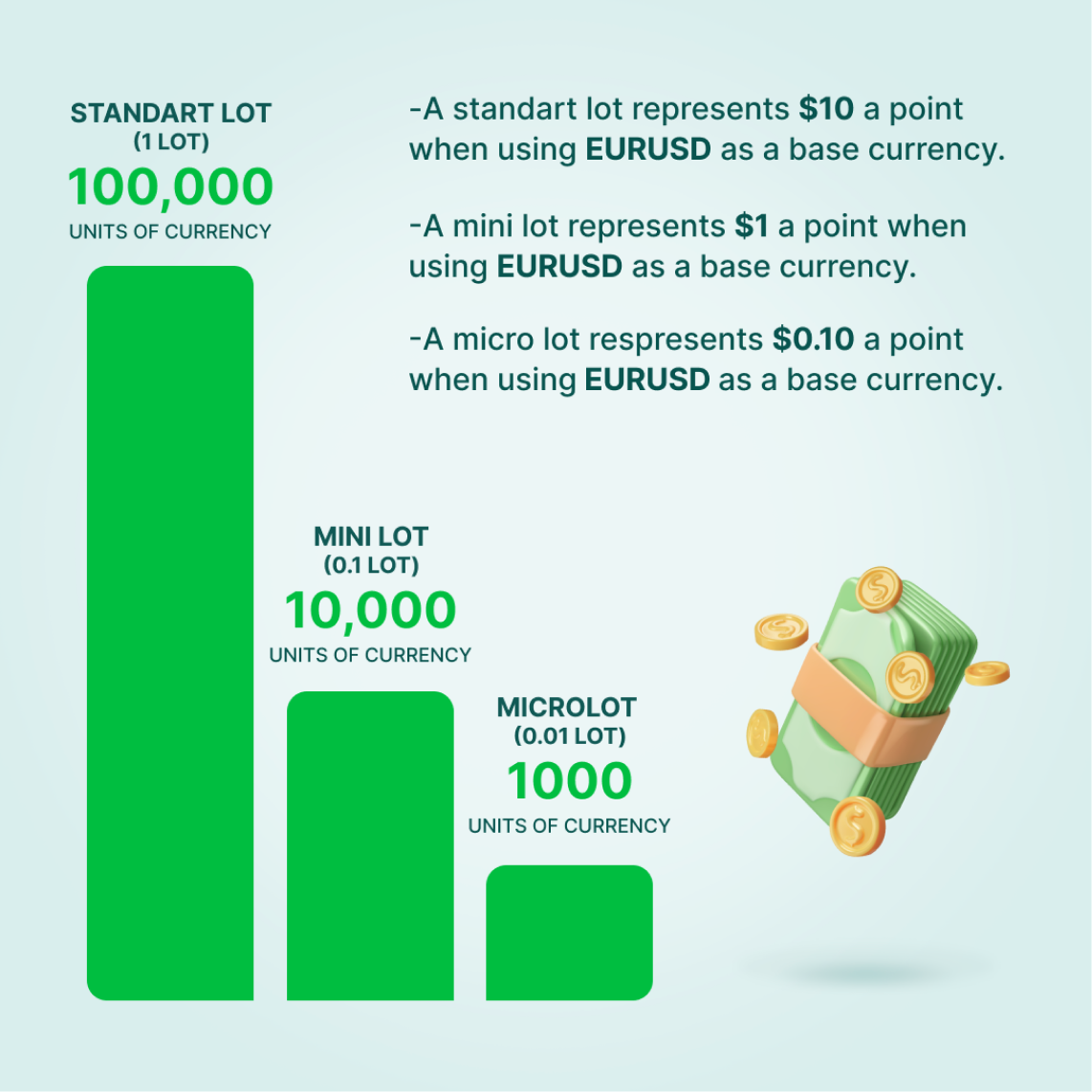

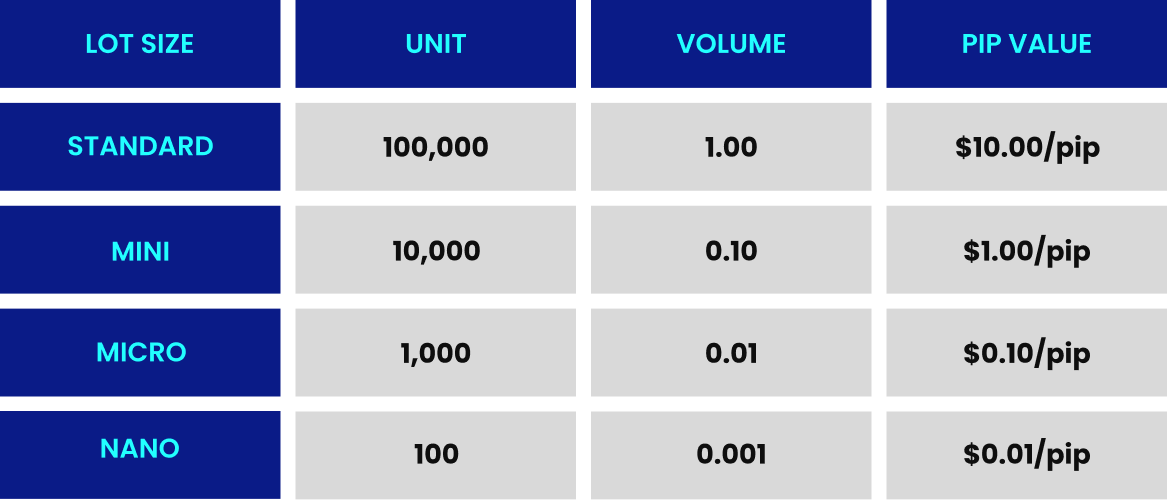

The forex market — where currencies are exchanged— operates with standardized lot sizes. A standard forex lot equals 100,000 units of the base currency. Additionally, smaller lot sizes such as mini lots (10,000 units) and micro lots (1,000 units) are available, enabling traders with limited capital to participate.

Forex brokers often offer a lot size calculator to assist traders in selecting the appropriate lot size based on account balance, risk appetite, and trading strategy.

Understanding Different Lot Sizes

How to Calculate Lot Size?

Accurately calculating your lot size is vital for effective risk management. Several factors influence the appropriate lot size for your trades:

Risk Tolerance: Each trader has a unique risk profile, which should guide lot size decisions. A common guideline is to risk no more than 1% of your total account equity on any single trade. This helps ensure losses remain manageable if the market moves against your position.

Account Balance: Your available capital significantly affects the lot size you can trade. Traders with larger balances may opt for bigger lot sizes but must keep trades aligned with their risk tolerance.

Stop-Loss: A stop-loss order is an essential risk control tool. The distance between your entry price and stop-loss level influences your lot size. A wider stop-loss allows for a larger lot size, while a tighter stop-loss necessitates a smaller lot size to stay within risk limits.

You can calculate the appropriate lot size using the following formula:

Position Size = (Risk Amount) / (Stop Loss in Pips × Pip Value)

For example, if you are willing to risk $200 on a trade with a stop-loss of 50 pips and a pip value of $10, the calculation would be:

Position Size = $200 / (50 × $10) = 0.4 Standard Lots

This calculation helps you maintain your risk parameters while determining the optimal lot size for each trade.

Using a Lot Size Calculator

Due to the complexity of manual lot size calculations, many traders prefer to use a lot size calculator. These tools factor in your risk tolerance, stop-loss distance, and account size to provide precise lot size recommendations. Utilizing a lot size calculator helps traders avoid costly errors and better manage their risk exposure.

Why Lot Size Matters in Trading

The lot size you trade directly impacts both your potential returns and risk exposure. Trading larger lot sizes magnifies both possible profits and losses, making it crucial to select an appropriate lot size aligned with your trading plan, risk tolerance, and prevailing market conditions.

In forex trading, understanding the distinctions between standard, mini, and micro lots is essential. For novice traders or those with smaller accounts, starting with micro or mini lots helps manage risk while maintaining market participation.

Lot size is a foundational concept in trading that influences your risk management and overall strategy. Whether trading equities, bonds, futures, or forex, choosing the correct lot size is vital for successful and responsible trading. '

Utilizing a lot size calculator and accurately determining the appropriate lot size for each trade can enhance your decision-making process and potentially improve trading outcomes.

Trade Smarter Today

Account

Account

Instantly