Gold Pips in India: How to Calculate Pip Value

In the ever-dynamic global financial markets, gold trading remains a perennial favourite among Indian investors and traders. As a tried-and-tested safe haven, gold consistently attracts those looking to shield their portfolios from inflation, currency swings, or broader market turbulence. For those traders especially those that trade in India that hedge against inflation, gold commodity trading is the perfect option tailored to their needs. As gold trading evolves in India, mastering the concept of pips — the smallest unit of price movement — is vital, especially when trading forex gold trading instruments like XAU/USD. That’s where a handy gold pips calculator becomes indispensable. This guide demystifies how to count gold pips and shows why they matter for your profit and loss, and which gold trading platform features can help you maximise your trading potential in the Indian market.

Why Do Gold Pips Matter?

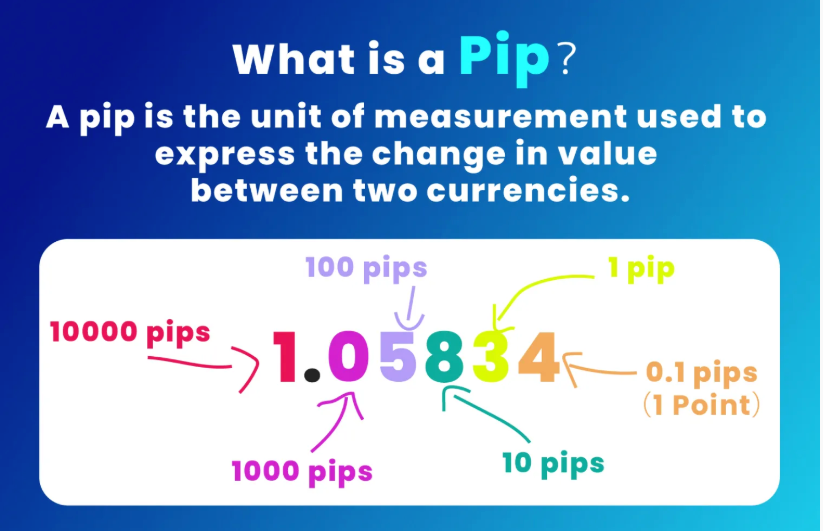

In gold trading, a “pip” is the standard unit used to measure the smallest change in price. In most cases, a pip is recorded at the fourth decimal place (0.0001). Understanding how pips work is crucial in both forex gold trading and gold commodity trading, as even small price fluctuations in XAU/USD can translate into significant profit or loss.

Getting Started with Gold Pip Calculation

Price Point Basics: In gold trading, prices are typically quoted in US dollars, with a standard lot representing 100 ounces. One pip usually equals 0.01 movement in the gold price. However, the pip value can differ depending on the gold trading platform or broker settings. For traders engaged in forex gold trading, understanding this pricing structure is vital to accurately calculate profit and losses.

Understanding Lots: Most brokers offering gold commodity trading use standard lots of 100 troy ounces for XAU/USD trades. At the same time, many gold trading platforms in India provide options for mini-lots and micro-lots, making it easier for retail traders to participate with smaller capital. Each lot size affects the value of a pip, and using a gold pips calculator can help traders quickly assess the financial impact of market moves.

Impact of Broker Platforms: The exact method of pip calculation can vary across forex gold trading brokers. Some platforms may quote gold to two decimal places (0.01), while others extend to three or more decimal points. This variation directly influences the pip value and ultimately affects trade outcomes. Indian traders should always confirm pip settings with their chosen gold trading platform to ensure accurate calculations when planning strategies.

Calculating Pip Value in Gold

Formula for Pip Value: The standard formula used in gold trading is:

Pip Value = (One Pip / Current Price) × Lot Size × Contract Size.

For example, if gold is priced at $1,800 per ounce, a 0.01 price movement (one pip) on a standard lot of 100 ounces would equal a pip value of $1.

Using Leverage: Trades use leverage to open larger positions with smaller capital. While leverage can magnify profits, even small pip movements can also increase losses. That’s why calculating pip values precisely is critical when trading on a gold trading platform. For those involved in forex gold trading, combining the pip formula with the correct lot size and leverage settings ensures smarter risk management and better decision-making in volatile gold markets.

Tips for Tracking Gold Pips Effectively

Real-Time Tracking: In gold trading, prices can shift rapidly throughout the day, particularly during major economic announcements or global geopolitical events. For international traders engaged in forex gold trading or gold commodity trading, monitoring pips in real time is essential to avoid missed opportunities. Many brokers provide built-in features on their gold trading platforms to help track these movements with precision.

Set Up Alerts: Most gold trading platforms now allow traders to set pip-based alerts. These alerts notify you when the market hits a specific price level, helping you act quickly to capture profitable trades. For those trading XAU/USD in India, pairing alerts with a gold pips calculator ensures that every movement is measured accurately, improving trade execution and risk management.

Use Chart Tools: Successful gold trading often involves more than just watching price ticks. Many Indian traders rely on charting tools such as moving averages, RSI, or Bollinger Bands to track pips effectively. These tools not only help identify market trends but also highlight potential entry and exit points in both forex gold trading and gold commodity trading strategies. Combining technical indicators with a reliable gold pips calculator can give traders a stronger edge in volatile markets.

Key Factors Influencing Gold Pip Movements

Economic Indicators: In gold trading, pip movements are heavily influenced by economic indicators such as inflation rates, interest rate decisions, and government policies. Announcements from the U.S. Federal Reserve often move XAU/USD prices significantly. At the same time, local factors such as Reserve Bank of India (RBI) monetary policy can indirectly affect the rupee’s strength, making pip movements even more relevant when calculated with a gold pips calculator.

Market Sentiment: Gold’s reputation as a safe-haven asset makes it highly responsive to global uncertainty. During periods of market volatility or geopolitical instability, demand for gold tends to rise, leading to sharper pip fluctuations. Traders who rely on a gold trading platform need to track sentiment closely to identify potential entry and exit opportunities. Using real-time tools alongside a gold pips calculator can help traders measure the financial impact of these shifts accurately.

Currency Strength: Since gold is priced in U.S. dollars, the value of the USD directly impacts gold’s pip movements. A stronger dollar typically pushes gold prices lower, while a weaker dollar tends to support higher gold prices. For Indian traders, monitoring USD/INR movements alongside XAU/USD is key to making smarter decisions in both forex gold trading and gold commodity trading. Understanding these currency interactions gives traders a clearer perspective when using pip values to plan trades on their chosen gold trading platform.

Gold Pips Strategies to Consider

Scalping for Small Gains: In gold trading, scalping is a strategy suited for short-term traders who aim to capture quick profits from minor pip movements. Scalpers often place multiple trades in a single day, relying on speed and precision available through advanced gold trading platforms. Scalping can be effective when paired with a gold pips calculator to measure the impact of even the smallest price shifts.

Swing Trading for Trends: Swing trading Swing trading focuses on identifying broader market trends and holding positions for several days or weeks. Indian traders in gold commodity trading often use technical analysis tools to anticipate significant pip movements in XAU/USD. By combining chart analysis with a gold pips calculator, swing traders can better manage their risk and optimize entry and exit points.

Long-Term Holding: Some investors treat gold as more than just a short-term trade; it is also seen as a hedge against inflation and rupee depreciation. In this approach, pip data is used to refine entry and exit levels, but positions are generally held for extended periods. Whether through forex gold trading or traditional gold commodity trading, long-term holding strategies appeal to those who value stability. Selecting a reliable gold trading platform is crucial for executing and monitoring these long-term positions effectively.

Common Mistakes When Counting Gold Pips

Overlooking Broker Specifications: One of the most frequent errors Indian traders make in gold trading is ignoring how different brokers define pips for gold. Some gold trading platforms may calculate pip values at two decimal places (0.01), while others extend to three or more. For those active in forex gold trading or gold commodity trading, clarifying these broker specifications is essential to avoid miscalculations. Using a gold pips calculator aligned with your broker’s system ensures greater accuracy.

Ignoring Lot Size: Another mistake is failing to account for the lot size being traded. Pip values vary significantly depending on whether you are trading a standard lot, mini-lot, or micro-lot. Indian traders who want to manage smaller positions in gold trading should verify the lot size before entering a trade. Tools like a gold pips calculator make it easier to understand how lot size impacts the final pip value, helping retail traders better plan their strategies.

Neglecting Risk Management: Many beginners in gold trading focus solely on pip movements without considering risk management. In highly leveraged trades, even small pip changes can result in large losses. For Indian traders using forex gold trading platforms, combining pip analysis with proper risk management strategies can make all the difference. A balanced approach ensures that both gold commodity trading and leveraged trades remain sustainable in the long run.

Thoughts on Mastering Gold Pips

Counting gold pips with accuracy is a fundamental skill for anyone serious about gold trading in India . By understanding the variables that influence pip values and by using reliable tools like a gold pips calculator, traders can manage their positions with greater precision. Whether you’re active in forex gold trading or prefer gold commodity trading, mastering pip calculations gives you a stronger edge in the market.

Gold’s unique dynamics require traders to stay updated on global economic events, as well as shifts in the rupee and U.S. dollar. Tracking these developments while using the right gold trading platform ensures smarter decision-making and better risk management.

Ready to take your skills further? TMGM’s gold trading platform offers comprehensive resources designed for Indian traders—from real-time data and educational guides to practical trading tools. Whether you’re new to forex gold trading or an experienced participant in gold commodity trading, TMGM equips you with the insights you need to trade confidently and effectively.

Trade Smarter Today

FAQs on Gold Pips in Trading

How do I calculate gold pips in forex gold trading?

What is the difference between forex gold trading and gold community trading in India?

Which gold trading platform should beginners in India use for pip tracking?

How does IIBX affect gold trading in India?

Account

Account

Instantly