Crude Oil Trading: Beginner’s Guide

Crude oil is among the most actively traded commodities globally, presenting traders with substantial opportunities thanks to its price volatility, liquidity, and critical role in the global economy. For beginners entering this market, grasping the fundamentals and formulating suitable trading strategies is crucial for achieving success. Whether you are an experienced trader aiming to diversify your portfolio or a novice seeking to engage with the world’s most traded commodity, this guide will provide you with essential insights and actionable steps to trade crude oil efficiently.

Understanding Crude Oil Markets

Figure 1: Brent and WTI

Crude oil is unrefined petroleum and serves as the primary feedstock for gasoline, diesel, and plastics production. As a finite commodity with variable supply and demand dynamics, its price is subject to significant volatility, offering trading opportunities globally. The global oil market operates 24/7 across multiple exchanges, with prices reflecting complex interactions among producers, consumers, and speculators.

Two main benchmarks dominate the global crude oil market. West Texas Intermediate (WTI) is the US benchmark known for its light and sweet characteristics (low sulfur content), making it optimal for gasoline refining. It's primarily traded on the New York Mercantile Exchange (NYMEX). Brent Crude is the international benchmark sourced from the North Sea.

It's slightly heavier than WTI and traded on the Intercontinental Exchange (ICE). Other key crude types include Dubai/Oman crude, the Middle East benchmark, and the OPEC Reference Basket, which represents a weighted average of crude oils produced by OPEC members.

What Drives Crude Oil Prices?

Grasping the primary factors influencing crude oil prices is crucial for effective trading. On the supply side, OPEC (Organization of Petroleum Exporting Countries) decisions play a pivotal role, as they control a significant portion of global oil output. Their production quotas can trigger substantial price fluctuations. Additionally, weekly inventory reports from the U.S. Energy Information Administration (EIA) impact prices as traders respond to supply changes. Geopolitical developments, such as conflicts or supply disruptions in oil-producing regions, can lead to abrupt price spikes.

On the demand side, economic growth is a major driver—strong economies increase energy consumption, boosting oil demand. Seasonal patterns also influence demand, with higher consumption during summer driving seasons and winter heating periods. Currency fluctuations are another important factor—since oil is priced in U.S. dollars, a stronger dollar raises oil costs for foreign buyers, potentially reducing demand and exerting downward pressure on prices.

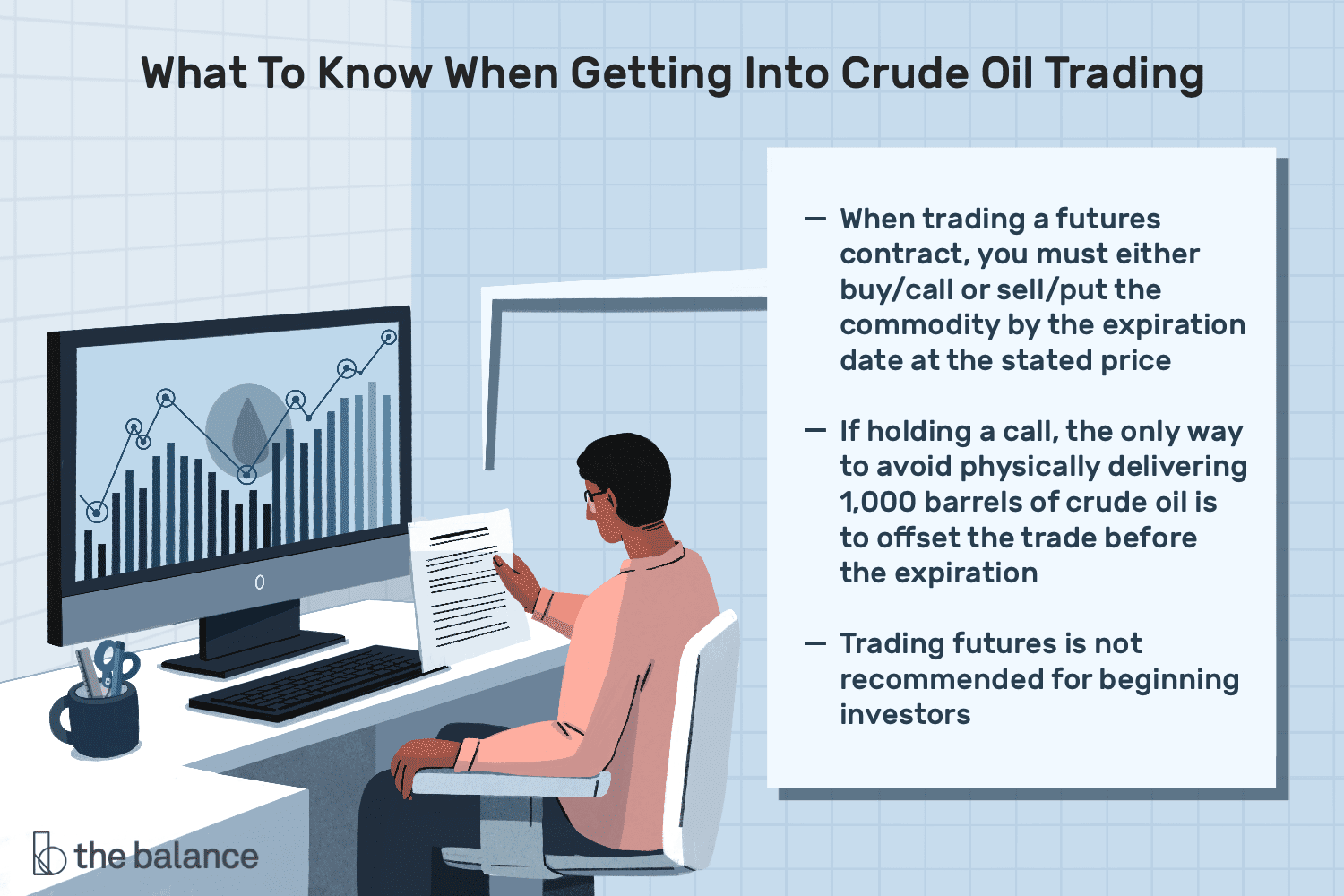

Figure 2: Key Considerations When Trading Crude Oil

Methods to Trade Crude Oil

There are several ways to trade oil, each with distinct advantages and risks.

CFDs (Contracts for Difference): A preferred choice for beginners, oil CFDs enable traders to speculate on price movements without owning the physical commodity. CFDs require lower capital outlay and allow both long and short positions, enabling profits from rising and falling prices. They also eliminate concerns related to storage or delivery.

Oil Futures: These standardized contracts set a price for buying or selling oil at a future date. They require higher capital and a thorough understanding of contract expiry but are favored by experienced traders.

Options Contracts: These provide the right, but not the obligation, to buy or sell oil at a predetermined price. While risk is limited to the premium paid, mastering options pricing is essential.

ETFs (Exchange-Traded Funds): A straightforward option, oil ETFs track oil prices or invest in oil-related companies, allowing traders to gain exposure to the oil sector via a standard brokerage account.

How to Begin Trading Oil

Figure 3: Common Trading Strategies

Educate Yourself: Understand oil price drivers, trading methodologies, and technical analysis to optimize trade timing. Follow industry reports and news updates to remain informed.

Select Your Trading Instrument: Decide whether CFDs, futures, or ETFs align best with your capital, risk appetite, and trading objectives. Beginners often prefer CFDs due to their flexibility and lower capital requirements.

Choose a Reliable Broker: Opt for a regulated broker offering competitive pricing, a user-friendly platform, and robust customer support. Access to a demo account is beneficial for practice.

Develop a Trading Plan: Define clear entry and exit criteria, risk management protocols, and profit targets to maintain discipline.

Practice with a Demo Account: Test your strategies in a risk-free environment before committing real capital to build confidence and refine your approach.

Start Small and Scale Gradually: Begin with modest trade sizes and increase positions progressively as you gain experience.

Risk Management in Oil Trading

Given the high volatility of oil prices, effective risk management is critical:

Position Sizing: Limit risk to no more than 1-2% of your trading capital per trade to avoid significant losses.

Stop-Loss Orders: Always implement stop-loss orders to automatically close losing positions at predefined levels.

Leverage Management: While leverage can amplify gains, it also increases potential losses. Use leverage prudently.

Diversification: Avoid concentrating all capital in oil; diversify your portfolio with other asset classes to mitigate risk.

Common Pitfalls for New Traders

Many novice traders face challenges due to:

Overtrading: Excessive trading can impair judgment and increase transaction costs. Focus on high-probability setups.

Neglecting Fundamentals: Price action is influenced not only by charts but also by inventory data, OPEC policies, and macroeconomic trends.

Emotional Trading: Emotions like fear and greed can cause premature exits or holding onto losing trades. Adhere strictly to your trading plan.

Insufficient Preparation: Entering live trading without adequate knowledge often results in losses. Prioritize education and practice.

Optimal Trading Times for Oil

Oil price volatility peaks during:

EIA Inventory Releases: Published Wednesdays at 10:30 AM ET, often triggering sharp price movements.

OPEC Meetings: Decisions on production quotas during these meetings can cause significant price shifts.

Market Trading Hours: Highest liquidity occurs during U.S. market hours (9:00 AM - 2:30 PM ET) and the U.S.-European market overlap (8:00 AM - 11:00 AM ET).

Elevate Your Oil Trading

After mastering the fundamentals, consider advanced strategies:

Market Correlations: Oil prices often correlate with USD/CAD (reflecting an oil-exporting economy) and energy sector equities.

Long-Term Cycles: Oil prices exhibit multi-year cycles influenced by technological progress, supply expansions, and demand shifts.

Seasonal Patterns: Seasonal demand increases in summer or refinery maintenance in winter can drive predictable price changes.

Multi-Timeframe Analysis: Utilize multiple timeframes to identify long-term trends, intermediate phases, and short-term entry points.

Figure 4: Steps to Trading Crude Oil

Steps to Trading Crude Oil

Understand the fundamentals of oil trading

Learn the key drivers of oil prices

Choose your preferred trading instrument

Open your trading account

Identify trading opportunities

Place your first oil trade

Monitor and close your positions

Why Trade Oil CFDs with TMGM

TMGM delivers a premium oil trading experience through our advanced CFD platform, engineered to provide traders with an edge in volatile oil markets. Trading oil CFDs with TMGM grants you access to:

Competitive Benefits

Tight Spreads: Trade oil CFDs with some of the industry’s tightest spreads, maximizing profit potential on every position.

Advanced Execution Technology: Our cutting-edge trading infrastructure ensures fast order execution with minimal slippage, even amid high volatility.

High Leverage Options: Access leverage up to 1:20 on oil trades, enabling larger exposure with smaller capital requirements.

Negative Balance Protection: Trade with confidence knowing your account balance cannot fall below zero, regardless of market conditions.

Comprehensive Oil Market Access

TMGM provides access to the energy sector via CFDs on major oil benchmarks. Traders can access CFDs on Brent Crude Oil (XBRUSD) and WTI Crude Oil (XTIUSD) spot contracts.

These instruments allow speculation on oil price fluctuations without owning the physical commodity. With leverage up to 1:200, TMGM caters to both novice and experienced traders engaging in global oil markets.

TMGM offers advanced trading tools and educational content to enhance your oil trading experience. Access over 50 technical indicators, a trading calendar highlighting key market events, and risk management features such as stop-loss and trailing stop orders. Our mobile app ensures seamless trading on the move.

For education, TMGM provides market analysis, live webinars, video tutorials, and comprehensive trading guides, equipping traders with the knowledge and strategies needed for informed decision-making in oil markets.

Our multilingual support team is available 24/5 to assist with any inquiries, ensuring you receive dedicated support throughout your trading journey.

Trade Oil with TMGM

Diversify your portfolio by trading CFDs on the world’s largest oil markets.

Trade Smarter Today

Account

Account

Instantly