Algorithmic Trading Simplified: Utilizing Python with MetaTrader 5

Trading with algorithms may appear to be a complex strategy reserved for technically skilled traders, but it is now more accessible than ever. With some learning, guidance, and practice, even novice traders can leverage automation using Python to develop and deploy trading algorithms via MetaTrader 5 (MT5). This guide will introduce you to the fundamentals of algorithmic trading setup, including practical examples and scripts designed to transform your trading strategy.

What is Algorithmic Trading?

Algorithmic trading, often referred to as algo trading, utilizes computer programs to automate various facets of trading. Just as automation enhances efficiency in everyday tasks, automating elements of your trading strategy can offer significant advantages. Traders may consider algorithmic trading for several reasons:

Speed and Precision: Algorithms can process data and respond to market fluctuations faster than humans, significantly boosting trade execution speed.

Optimization: Automated trading systems help minimize emotional biases and enhance the efficiency of specific trading strategies.

Scalability: Algorithms can manage multiple trades across various markets simultaneously, providing traders with the ability to scale their operations effectively.

In summary, algorithms equip traders with a critical competitive advantage in the fast-moving trading environment.

About MetaTrader 5 API

MetaTrader 5 is a premier trading platform known for its sophisticated technical analysis tools and adaptability. Key features of MT5 for algorithmic trading include:

Built-in Analysis Tools: Traders can conduct advanced technical analysis using MT5’’s extensive indicators and charting capabilities.

Customizable Trading Systems: MT5 offers robust support for algorithmic trading, enabling traders to design and automate their strategies.

API Integration: MT5 provides Application Programming Interface (API) integration, allowing seamless connection of live trading accounts to custom automation scripts.

Using Python

Python is one of the most widely used programming languages globally, valued for its versatility and user-friendly learning curve.

Beginner-Friendly: Python’’s clear syntax makes it accessible to beginners, including those without prior coding experience.

Library Support: Widely-used libraries such as pandas (for data analysis), matplotlib (for visualization), and MetaTrader5 (for trading operations) streamline the development and automation of trading strategies.

Large Community and Strong Support: Python benefits from a vibrant global community offering extensive resources, forums, and tutorials for troubleshooting and learning.

Combined with the MT5 API, traders can effectively develop, backtest, and deploy trading algorithms using Python.

Step-by-Step Guide to Setting Up a Trading Algorithm with Python and MT5

Download and Install MT5 and Python

Download the TMGM MT5 client

Install Python from python.org

Use Pip to install essential libraries

pandas (for data analysis, time series, and statistics)

matplotlib (for chart plotting)

Metatrader 5 (for MT5 API integration with Python)

Tips:

If the command ‘python’ does not execute in your terminal, try ‘python3’.

Run the terminal with administrator privileges to prevent permission errors.

Connect Python to MT5

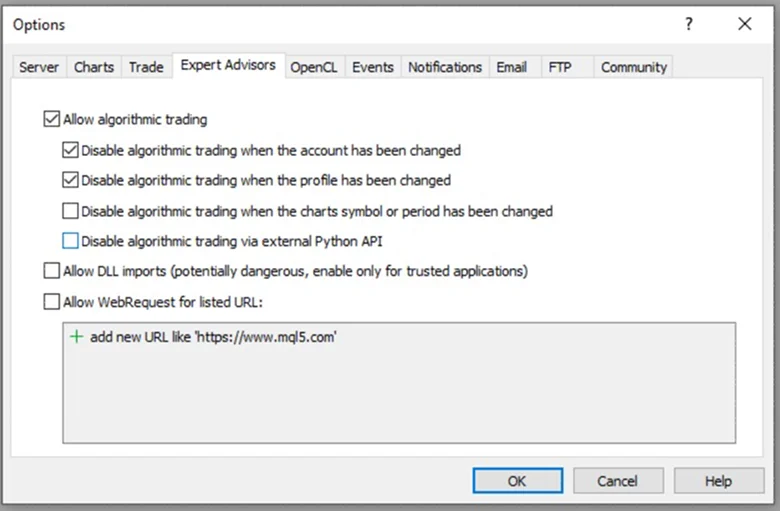

Launch MT5 and log in to your live or demo trading account.

Navigate to Tools > Options > Expert Advisors, and ensure the “Allow Algorithmic Trading” checkbox is enabled.

Open Command Prompt with administrative rights.

Execute the Python script below to verify the connection with MT5.

Example Python code:

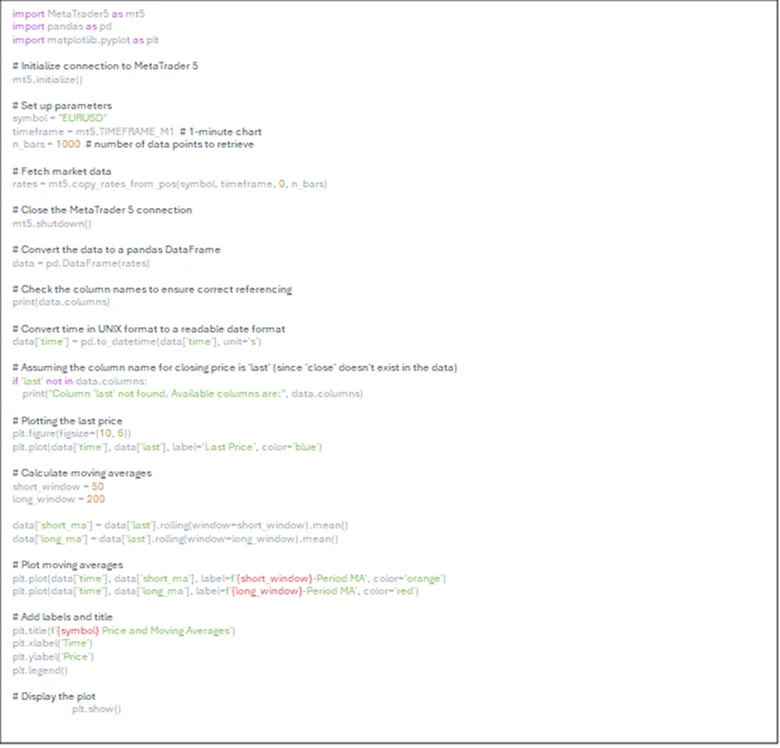

Fetch Live Market Data

Using the MT5 API, we can retrieve real-time price and market data. For instance, we can obtain data for EURUSD.

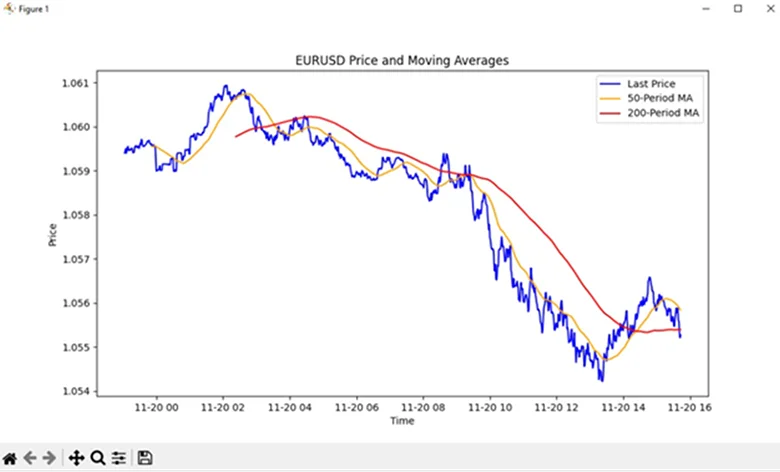

This will display a visualization of the live data, as shown below.

Define the Trading Rules

Implement a trading algorithm based on specific criteria or conditions. In this example, we use a simple moving average crossover strategy as follows:

Buy Signal: The short-term moving average crosses above the long-term moving average.

Sell Signal: The short-term moving average crosses below the long-term moving average.

To visualize the moving averages, matplotlib can be used to plot them with the example code below:

The moving averages (MA) will be displayed as illustrated below.

Algorithmic Trading Script

Sample code snippet:

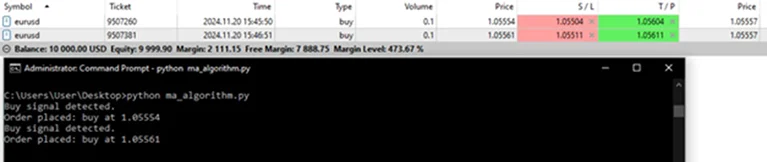

The algorithm runs continuously in a loop, automatically placing trades based on the predefined trading rules.

You can monitor executed trades in the Toolbox Window within MT5.

To stop the algorithm, simply press “Control + C” in the command prompt or terminal window.

Explanation and Notes on the Sample Code

Fetch and Prepare Trading Data

Retrieves historical price data for the specified symbol (EURUSD) and timeframe (M1 – 1 Minute).

Calculates two moving averages (short_ma and long_ma) using pandas’ rolling() function.

Generate Signals

A signal column is created to indicate trade entries and exits based on the crossover of moving averages.

Place Trades

Based on the most recent signal, the script executes buy or sell orders.

Risk Management

The example assumes a fixed trade volume of 0.1 lots. Adjust this parameter to align with your risk appetite and trading plan.

Testing

Always test your automated trading strategies and scripts on a demo account before deploying them in live markets to identify and resolve issues.

Explore Algorithmic Trading with TMGM

The example provided is a basic illustration; the possibilities for developing and refining trading algorithms are virtually limitless. Python combined with MT5 empowers traders to create and optimize strategies that excel in execution speed, accuracy, and market responsiveness.

Partner with a trusted and innovative broker like TMGM to access the essential tools and support needed for success in algorithmic trading.

With TMGM, elevate your algorithmic trading experience: gain access to advanced trading platforms, the MetaTrader 5 API, deep liquidity pools, and a broad range of markets. Whether you are a novice or an experienced, technology-driven trader, TMGM offers the resources, education, and robust infrastructure to seamlessly integrate and automate your custom trading strategies.

Ready to Get Started?

Register now and gain access to global financial markets in under three minutes.

Trade Smarter Today

Account

Account

Instantly